Re-balanced 401(k)

When I started my first full-time job after college, the most insistent advice I got was to contribute to my 401(k). "Isn't that for retirement?" I asked incredulously...but I contributed anyway, because I figured that refusing the employer match is like giving away money to Bill Gates. (And I'm no Warren Buffett.)

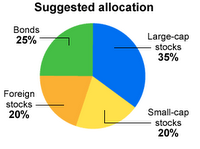

I'm currently putting away a little over 18% of each paycheck to my 401(k), to stay in a retirement fund until at least 2042. But I'm still not sure what make of my portfolio. An article from Money Magazine lends to a basic understanding, saying that a 10% contribution is "good." (Does this mean I should scale back on my contributions? Then I'd lose the employer match of 37.5% on 4% - which really means 1.5%, so why don't they just say that - better a measly match than none at all?) The guide suggests certain funds: the "Indexes," and funds with low expense rations (basically, funds labelled "Small-Cap Value" or "Large-Cap Growth"). And it also suggests using a risk assessment calculator, which churned out the suggested allocation on the right.

The guide suggests certain funds: the "Indexes," and funds with low expense rations (basically, funds labelled "Small-Cap Value" or "Large-Cap Growth"). And it also suggests using a risk assessment calculator, which churned out the suggested allocation on the right.

Somehow, the fund performances in my company's 401(k) can't convince me to adopt these percentages. Instead, I've re-balanced to: 15% in large-cap stocks, 20% to small-cap and specialty stocks, and 45% in foreign stocks. (I hope markets outside the States keep it up!)

And that's my newly balanced and re-aligned 401(k). I'm also looking into a Roth IRA right now. (PTF)

No comments:

Post a Comment